Have you ever wondered about the term “macroeconomics” and its role in your investments? It’s the study of big economic factors that shape our economy. Understanding macroeconomics is key to making smart investment choices1. This article will show you how macro trends and policies affect your investments, helping you make better decisions.

Knowing about macroeconomic drivers like market performance and GDP is vital for smart investing2. Macroeconomics looks at the big picture, including interest rates and unemployment. On the other hand, microeconomics focuses on smaller units like households and companies2.

Studying macroeconomics gives you insights into the economy’s health and potential risks or opportunities for your investments2. Experts use big data to understand the economy’s overall state2. By learning economics, you can spot companies that use resources well and might offer good returns.

Key Takeaways

- Macroeconomics looks at big economic data, while microeconomics focuses on smaller units like households and companies.

- Experts use big data to understand the economy’s overall state.

- Knowing about macroeconomic factors like inflation can help with investment strategies.

- Microeconomics can help find companies that use resources well and might offer good returns.

- Learning both macroeconomics and microeconomics gives a full view of the economic landscape.

Understanding Macroeconomic Factors

Macroeconomics looks at three main things: how much a country makes (GDP), how many people work (unemployment rate), and how prices change (inflation rate)3. GDP shows the total value of all goods and services made in a country3. Real GDP is better than nominal GDP because it takes into account inflation3. The unemployment rate shows how many people can’t find jobs3. Inflation is tracked through the CPI and GDP deflator, showing how fast prices are going up3.

Economic Growth and Its Impact

Economic growth, shown by changes in GDP, is key for investment decisions3. It’s important for the economy to grow steadily, measured by GDP changes4. When the economy grows, people invest more, spend more, and feel better about the market. But when it slows down, people might be more careful with their money.

Inflation: A Double-Edged Sword

Inflation, a rise in prices, affects investments in two ways3. It’s a big factor in keeping prices stable4. Low inflation is good for the economy and some investments. But high inflation can reduce how much money people can buy, raise interest rates, and make markets uncertain, hurting investments.

Studying the economy helps predict what will happen to help people, businesses, and governments make better choices3. Economic cycles show that when demand goes up, prices do too, making people spend less, showing how supply and demand work together5. Important things to watch include GDP growth, money supply, job rates, inflation, debt, and stock market ups and downs4.

Macroeconomic theories have limits because they can’t fully capture human behavior and the effects of things like rules and taxes. It’s key to look at real numbers and theories together when making money choices4.

| Macroeconomic Factor | Significance |

|---|---|

| Gross Domestic Product (GDP) | A crucial indicator of national output and economic growth |

| Unemployment Rate | Reflects the availability of jobs and the health of the labor market |

| Inflation Rate | Measures the rate of increase in consumer prices, impacting purchasing power |

“Macroeconomic analysis helps governments in developing effective policies and sustaining economic growth.”3

The Role of Monetary Policy

Monetary policy is key to shaping the economy. Central banks like the Federal Reserve play a big role6. They aim to keep the economy strong and prices stable6. The Federal Reserve meets often to decide on policies6.

Changes in interest rates and the money supply affect investments6. In the 1980s, the Federal Reserve raised rates to 20% to fight inflation6. This brought inflation down to 3% to 4%6. The Federal Reserve uses different tools to manage the economy6.

Knowing what monetary policymakers do helps investors plan better6. They use tools like open market operations and adjust interest rates6. These tools help control inflation and boost the economy when it’s slow6.

An expansionary policy can lower unemployment by helping businesses grow and create jobs.6 The main goals are to keep inflation low, reduce unemployment, and manage currency values6. During the COVID-19 pandemic, both monetary and fiscal policies worked together6.

The Federal Reserve helps banks in tough times to avoid failures and panic6. Data on interest rates, inflation, and GDP can show how well these policies work6.

7 In a study, opinions on economic goals varied widely7. The 1920s saw debates on monetary policy’s impact7. The 1930s Great Contraction made people doubt monetary policy’s power7.

7 For about 20 years, many thought monetary policy was outdated7. But after World War II, people started believing in its power again7. New theories showed how money affects the economy7.

7 Studies showed that during the Great Contraction, the U.S. made policies that reduced the money supply by a third7. This led to a comeback of trust in monetary policy7. Today, most economists agree on its importance7.

“The Federal Reserve acts as a lender of last resort, providing liquidity to banks to prevent financial failures and panic.”

Fiscal Policies and Their Effects

Fiscal policies, which include government spending and taxes, greatly affect the economy and investment chances8. When the government spends more and taxes less, it can make the economy grow by making people and businesses more confident8. On the other hand, cutting spending and raising taxes can help control inflation and reduce budget deficits.

It’s important for investors to watch how fiscal policies change to match their investment plans9. Changes in government spending can affect the economy in many ways, like making it harder for the private sector to grow, changing housing and stock prices, and shifting currency values9. But, changes in government income can boost GDP, private investment, and currency value.

Government Spending and Taxation

8 In the 1930s, the U.S. had 25% unemployment, leading to President Roosevelt’s expansionary fiscal policy10. This included the New Deal, creating new agencies and Social Security. Fiscal policy can also change what people want to buy by issuing bonds, which might make it harder for private companies to borrow10. Automatic measures like unemployment insurance and progressive taxes help smooth out economic ups and downs. But, making fiscal policy changes can be hard because it takes time to see the effects.

| Fiscal Policy | Impact on GDP | Effect on Private Sector | Impact on Exchange Rates |

|---|---|---|---|

| Expansionary | Stimulates growth | Potential “crowding-out” effects | Depreciation of real effective exchange rate |

| Contractionary | Curbs inflation | Increased private investment | Appreciation of real effective exchange rate |

10 Today, expansionary fiscal policy can be a burden for future generations with debt and higher taxes10. Some think tax cuts might not change saving habits, but most economists disagree, seeing fiscal policy as complex and far-reaching10.

“Fiscal policy is a powerful tool in the government’s arsenal to stimulate economic growth, but its implementation requires careful consideration of the potential trade-offs and unintended consequences.”

Understanding fiscal policies and their effects helps investors make better choices and adjust their strategies for the changing economy8910.

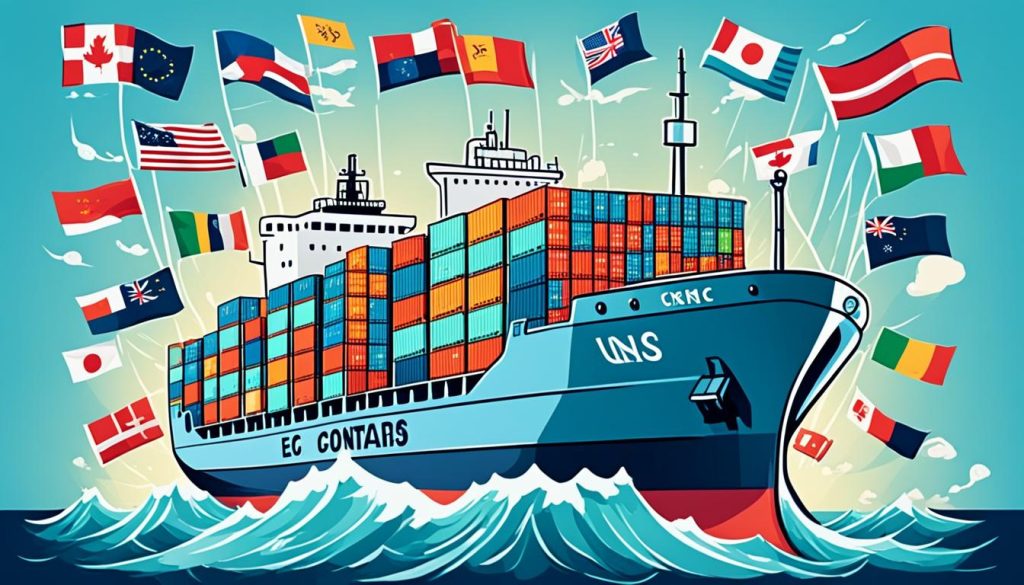

International Trade and Exchange Rates

In today’s global economy, the link between international trade and exchange rates is key for investors. Changes in exchange rates, trade deals, and tariffs can change how competitive companies are. They also affect the returns on investments worldwide. Knowing these factors is key for investors looking to grow their portfolios in global markets.

Navigating Global Markets

Countries that want more of their goods tend to export more, making their currency more sought after11. On the flip side, those importing more than they export see less demand for their currency11. These trade differences can make currencies go up or down in value, especially in floating rate systems11.

Trade surpluses mean a country sells more than it buys, making its currency more valuable11. Trade deficits, however, can lower the demand for a currency, causing it to drop in value11.

A currency drop makes a country’s exports cheaper, making them more appealing11. These trade balances affect currency demand and prices11. A higher exchange rate can make exports pricier and imports cheaper11. When a country’s goods and services are in demand, its currency’s value goes up11.

Changes in currency exchange rates impact prices, currency value, and trade balance11.

The U.S. dollar’s value changes in the mid-1980s greatly affected trade links12. The yen’s rise since 1993 had big effects on trade in the APEC region12. After moving to floating rates, exchange rate swings grew, with the USD/Yen rate’s monthly changes more than tripling12.

APEC economies saw real exports and imports grow over 6% a year from 1973 to 199312. Fast-growing countries in East Asia saw trade expand quickly12. Trade growth rates varied a lot across APEC economies from 1973 to 199312.

Imports in APEC economies often differed from their exports, with some importing primary goods and others mostly importing manufactured goods12. The mix of manufactured goods in APEC economies’ exports varied a lot, with some focusing on primary goods and others on manufacturing12.

“Navigating the complexities of global markets requires a deep understanding of the intricate relationship between international trade and exchange rates.”

Business Cycles and Their Implications

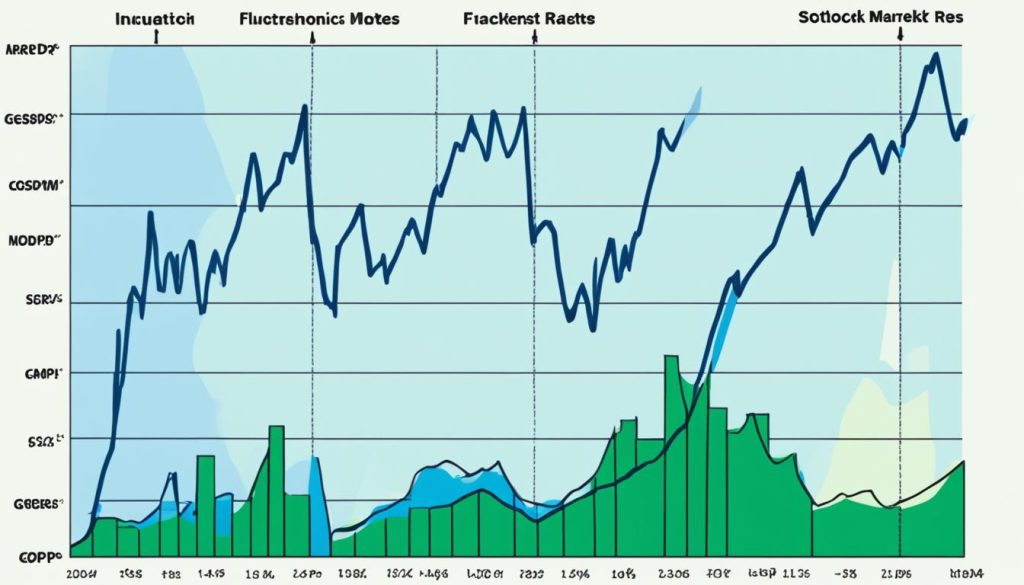

The economy goes through ups and downs due to macroeconomic forces, known as business cycles. These cycles affect how well different assets and investments do. Investors who get these cycles can adjust their plans to make the most of market changes.

Understanding Economic Fluctuations

Business cycles include times of growth and times of shrinkage. In the U.S., these cycles are key to the economy13. On average, growth periods last about 65 months, while downturns last about 11 months from 1945 to 201913. The longest growth period was from 2009 to 2020, lasting 128 months13. But, the Great Depression had many downturns, one lasting 44 months13.

These ups and downs affect investors a lot13. For example, the Dow Jones and S&P 500 fell a lot during the Great Recession, by 51.1% and 56.8%, from October 2007 to March 200913. The NBER waits for new data before saying when a recession starts or ends13.

Before World War II, growth periods were shorter, lasting about 26 months, and downturns lasted about 21 months14. Since the 1950s, a cycle in the U.S. economy lasts about five and a half years, with a big range, from 18 months to the 2009 expansion14. The NBER found two peaks in the U.S. economy from 2019 to 2020, one in the fourth quarter of 2019 and another in February 202014.

Knowing about business cycles and economic fluctuations helps investors move through the changing market15. GDP is key in understanding these cycles, from one trough to another or peak to peak14. Investors who can predict and adjust to these cycles can find good investment chances and lower risks.

“The strongest analysis of the business cycle should give us some indication of what is likely to happen next, in order to improve the quality of decision-making.”

Macroeconomics and Investment Strategies

Understanding the big picture of the economy is key to smart investment strategies. By looking at big economic factors, investors can make better choices about asset allocation, portfolio diversification, and risk management16. This helps match your financial goals with the economy’s shifts and handle market ups and downs.

Looking at economic growth is important. When the economy is growing fast, some areas do well, while others might not. Knowing this helps you pick the right investments16. Also, watching inflation levels helps you adjust your investments to protect against rising costs.

Adding macroeconomic analysis to your investment plans gives you a leg up. For example, knowing what central banks do with monetary policy affects interest rates and cash flow16. Keeping an eye on fiscal policies, like government spending and taxes, shows where to find opportunities and risks in different areas.

Also, understanding global economic trends and exchange rate changes helps with investing in international markets16. By matching your investment strategies with the economy’s ups and downs, you can protect your investments and grab new chances.

“Macroeconomic analysis is not just a tool for economists; it’s a crucial element in the arsenal of savvy investors who seek to navigate the ever-changing economic landscape.” – John McGee, renowned macroeconomist16

In short, using macroeconomic insights in your investment strategies helps you make smarter, flexible choices. This can boost the success and strength of your investment portfolio over time.

| Macroeconomic Factors | Potential Investment Implications |

|---|---|

| Economic Growth | Sector and asset class performance, portfolio allocation |

| Inflation | Adjustments to fixed-income and real asset holdings |

| Monetary Policy | Interest rate sensitivity, fixed-income strategies |

| Fiscal Policies | Sector opportunities and risks, government-related investments |

| Global Economic Trends | International diversification, currency exposure management |

| Business Cycles | Tactical asset allocation, risk management techniques |

Analyzing Macroeconomic Data

Understanding macroeconomic data is key to making smart investment choices. Looking at important economic indicators like GDP, inflation, unemployment, and interest rates helps a lot. These indicators give you clues about the economy’s future, helping you plan your investments.

Interpreting Economic Indicators

But, it’s important to look at macroeconomic data carefully. The economy changes fast, and knowing these indicators well is vital. Economic indicators like GDP, inflation, and unemployment show how healthy the economy is17. Understanding them takes a sharp eye and knowledge of how they work together.

For example, a higher GDP might mean the economy is growing, but it could also mean prices are going up18. This means you need to think carefully about your investments. By looking at these indicators and other economic factors, you can make choices that fit your investment goals.

| Economic Indicator | Significance for Investors |

|---|---|

| Gross Domestic Product (GDP) | GDP shows how big the economy is. If it’s growing, the economy might be doing well, which could mean more chances to invest. |

| Inflation | High inflation can lower the value of your investments. It’s important to know how it affects different types of investments and adjust your portfolio. |

| Unemployment Rate | Changes in unemployment can tell you about consumer spending and the job market. This helps you make better investment choices. |

| Interest Rates | Changes in interest rates can change how expensive it is to borrow money. They also affect the performance of certain investments. |

By keeping an eye on these economic indicators and using data analysis, you can keep up with the changing economy. This helps you make investment decisions that match your financial goals18.

“Macroeconomic data is the lifeblood of the investment world. By understanding and interpreting these insights, you can stay ahead of the curve and make informed decisions that position your portfolio for long-term success.”

Conclusion

Macroeconomics is key to shaping your investment strategy. It helps you understand economic growth1, inflation19, and more. Knowing about monetary and fiscal policies1 and international trade1 makes your investment smarter. By using macroeconomic analysis, you can make better investment choices.

Understanding business cycles1 helps you predict economic changes. This way, you can make your investments work better for the long run. Keeping an eye on economic indicators19 gives you insights into the economy. This helps you make smarter investment decisions.

Mastering macroeconomics is crucial for a strong investment strategy. It helps you understand how the economy affects different investments. With this knowledge, you can adjust your investments to match the economy’s changes. This way, you can achieve your financial goals and succeed in the long term.

FAQ

What is the role of macroeconomics in shaping investment decisions?

Macroeconomics helps investors by looking at big economic trends. It’s key for making smart investment choices. Knowing about economic indicators and trends can really help your investment plans.

How does economic growth affect investment opportunities?

Strong economic growth means more people spending and businesses investing. This can make some investments more attractive. But, when the economy slows down, investors might be more careful with their money.

What is the impact of inflation on investments?

Inflation can affect investments in two ways. A little inflation might mean a growing economy, which could help some investments. But high or unpredictable inflation can lower the value of money and make investments riskier.

How do monetary policies influence investment decisions?

Central banks use monetary policy to control the economy. Changes in interest rates and money supply can affect investments. Knowing what central banks do is key for investors to make smart choices.

What are the effects of fiscal policies on investments?

Fiscal policies, like government spending and taxes, can change the economy. They can make some investments more appealing. It’s important for investors to watch these policies to make the best investment choices.

How do international trade and exchange rates affect investment opportunities?

The global economy connects countries through trade and exchange rates. These factors can change how competitive companies are and affect investment returns. Investors should understand these to make the most of global markets.

What is the significance of business cycles in investment strategies?

Business cycles, driven by economic forces, affect the market. Knowing these cycles can help investors plan better. It lets them make the most of market changes.

How can investors integrate macroeconomic analysis into their decision-making process?

By studying macroeconomic factors, investors can make better investment choices. This might mean changing how they spread out their investments or using strategies to manage risks. Using macroeconomic analysis helps investors meet their financial goals.

What are the key macroeconomic data points that investors should monitor?

Keeping an eye on economic indicators like GDP and inflation is important. These data help investors understand the economy. But, it’s important to understand the economy’s complexity to make good investment decisions.

Source Links

- Macroeconomics Definition, History, and Schools of Thought

- Microeconomics vs. Macroeconomics Investments

- Explaining the World Through Macroeconomic Analysis

- Introduction to Macroeconomics

- Macroeconomic Factor: Definition, Types, Examples, and Impact

- Monetary Policy Meaning, Types, and Tools

- The Role of Monetary Policy

- All About Fiscal Policy: What It Is, Why It Matters, and Examples

- The macroeconomic effects of fiscal policy

- Fiscal Policy – Econlib

- How the Balance of Trade Affects Currency Exchange Rates

- No title found

- Business Cycle: What It Is, How to Measure It, and Its 4 Phases

- Economic Cycle: Definition and 4 Stages of the Business Cycle

- Business Cycles | Macroeconomics

- Applied Financial Macroeconomics and Investment Strategy: A Practitioner’s Guide to Tactical Asset Allocation Book – EVERYONE – Skillsoft

- Real-Time Data Set for Macroeconomists

- What are the benefits of analyzing macroeconomic data?

- Conclusions