As an investor, keeping up with inflation is key to your financial health. Lately, the U.S. has seen the highest inflation in decades, with prices up 2.9% from last year1. This rise affects how much things cost and challenges the old way of spreading investments1.

We’ve got Lara Rhame, our Chief U.S. Economist, sharing insights on inflation and what it means for investors1. Our 15-minute guides, reports, and podcasts offer deep dives into the economy, real estate, and corporate credit. They also cover how to handle a strong dollar, global changes, and similar market trends1.

Key Takeaways

- Understand the drivers of persistently high inflation and its impact on cost of living.

- Explore strategies for diversifying your portfolio and managing risk in the current market conditions.

- Gain expert insights on the economic outlook and the Federal Reserve’s role in controlling inflation.

- Learn about inflation-protected investment options, such as TIPS, and their potential benefits.

- Discover ways to generate income and build capital during periods of elevated inflation.

- https://criminalinjurylaw.com/legal-conspiracy-theories-how-the-system-is-rigged-against-victims-10/

Understanding the Impact of Rising Prices

Inflation and the Consumer Price Index (CPI)

The consumer price index (CPI) tracks inflation by watching the prices of goods and services2. When CPI goes up, it means living costs are rising. This affects your daily expenses, like groceries and rent. Knowing how CPI works and what affects it helps investors understand inflation‘s impact on their money.

How Inflation Affects Your Cost of Living

Rising inflation means your money doesn’t stretch as far. Expenses like food, gas, and bills take more of your budget, leaving less for fun and savings3. This can make family finances tight and force hard choices. Investors should watch how inflation changes their spending and savings plans.

“A little bit of inflation is seen as a sign of a healthy economy, with the Fed targeting a 2% annual inflation rate.”3

Central banks aim for inflation around 2% in developed economies and 3% to 4% in emerging ones23. But high inflation can reduce what money can buy. It deeply affects household budgets and consumer spending23.

Monetary Policy and Interest Rates

The Federal Reserve is key in fighting inflation with its monetary policy. It changes short-term interest rates to control spending and inflation4. When rates go up, borrowing money gets more expensive. This slows down the economy and can lower prices4. It’s important for investors to watch the Fed’s moves to guess how they’ll affect their money.

The Federal Reserve’s Role in Controlling Inflation

Since 2012, the Federal Reserve aims for an inflation rate of 2%5. In August 2020, it started using average inflation targeting to make up for inflation shortfalls5. The Fed watches the PCE Price Index, focusing on the core that excludes food and energy, for a steady inflation view5. To fight inflation, the Fed raises rates or limits money supply4. This plan changes borrowing, saving, and spending habits to fight inflation4.

The Federal Reserve has changed its monetary policy a lot lately. By May 3, 2023, the target rate was 5% to 5.25%5. But inflation was still at 3.1% by the end of January 2024, showing the Fed’s work is not done5. Economists argue about how well monetary policy fights inflation4.

Monetary policy’s effects on the economy and inflation can take time and are hard to measure4. The Fed’s actions, like buying or selling government bonds, affect financial markets and the economy a lot4. Investors and policymakers need to watch the Fed closely to understand its impact on inflation, rates, and growth.

“Deflation is considered more harmful than inflation, potentially leading to a recession or depression.”5

In summary, the Federal Reserve’s role in fighting inflation with monetary policy is key. By changing interest rates and using other tools, the Fed tries to keep prices stable and support growth. Investors should keep up with the Fed’s actions and their effects on their investments.

Strategies for Investing During Inflation

As inflation goes up, it’s key for investors to adjust their plans to keep their money safe. Using a mix of assets and spreading them out is crucial6. Things like real estate, commodities, and securities that keep up with inflation do well when prices are rising6. By mixing different types of investments, you can lessen the blow of inflation and aim for steady gains over time.

Asset Allocation and Portfolio Diversification

Spreading your money across various areas is a smart way to handle high inflation6. By investing in stocks, bonds, real estate, and commodities, you can shield your portfolio from the worst of rising prices6. This strategy helps keep your investments stable and can lead to steady returns, even when some areas are struggling.

Inflation-Protected Securities (TIPS)

Investing in Treasury Inflation-Protected Securities (TIPS) is a strong defense against inflation6. TIPS are special bonds that grow their value with the Consumer Price Index (CPI). So, as prices go up, TIPS grow too, protecting your buying power6. Adding TIPS to your fixed-income investments can help you earn returns that keep pace with inflation.

But, it’s vital to know how TIPS work before adding them to your portfolio6. Make sure they fit with your investment goals and how much risk you can take.

“Diversifying your portfolio across various asset classes can help mitigate the impact of inflation and provide more stable returns over the long term.”

| Asset Class | Inflation Hedging Potential |

|---|---|

| Real Estate | High6 |

| Commodities | High6 |

| TIPS | High6 |

| Stocks (Consumer Staples) | Moderate6 |

| Floating-Rate Loans | Moderate6 |

| Retail, Technology, Durable Goods | Low6 |

Implications for Economic Growth

The Federal Reserve is raising interest rates to fight inflation, which worries many about the economy’s future7. When inflation goes up, banks often lend less, especially those most affected by inflation7. In the U.S., loans grew by only 3.2% in 1977 because of inflation, much less than the usual 19%7. This drop in lending can slow down the economy, especially in areas like housing.

Rising inflation makes the economy complex and hard to understand8. Most experts say a little inflation, about 2% a year, is good for the economy because it encourages spending and investment8. But high inflation can hurt banks and slow down the economy, even leading to a recession.

Investors should watch GDP and job numbers to see how inflation affects their money and plan better8. The best GDP growth rate is seen as 2.5% to 3.5% a year without problems8. If GDP grows too fast, unemployment might go up. As the Federal Reserve tries to balance inflation and growth, investors need to stay alert and flexible.

| Economic Indicator | Impact of Inflation |

|---|---|

| Gross Domestic Product (GDP) | Elevated inflation can lead to slower economic growth, potentially causing a recession8. |

| Unemployment | High inflation can contribute to increased unemployment, as the Federal Reserve raises interest rates to combat rising prices8. |

| Consumer Spending | Rising prices in essential items like food and fuel can impact consumer spending on non-essential goods, affecting overall economic activity9. |

The Federal Reserve is tackling inflation, and everyone needs to stay ready for its effects on growth9. The Fed plans to keep raising interest rates in 2023 to fight high inflation9.

Wage Increases and Inflation

The link between wage hikes and inflation is complex. When prices go up, workers often ask for more money to keep their standard of living10. But, if wages increase too fast, it can lead to more inflation. This happens when companies raise prices to cover higher labor costs10. It’s a tricky situation for policymakers who aim to support workers and control inflation10.

Recently, wages and inflation have shown different trends10. Real wages have gone up for 12 straight months10. Yet, the growth in nominal wages has slowed down from 8.0% in April 2020 to 4.3% in March 202410. Inflation rates jumped from 0.3% in April 2020 to 5.4% in July 2021, then dropped to 3.1% in March 202410. Real wages saw a big drop from 1.9% in March 2020 to -3.4% in April 2021, but have slowly gotten better10. Now, nominal wage growth is slowing down, reaching 3.9% in the latest figures, just above the Federal Reserve’s goal10.

Lower-wage workers started seeing real wage growth early, with positive growth for 14 months as of March 202310. Also, 25% of people asked for a raise and half got it11. Plus, 29 states have raised the minimum wage since COVID-19 started, with 22 doing so this year alone11. California even set a minimum wage of $20 per hour for fast-food workers11.

Finding the right balance between wage increases and inflation is crucial for workers and policymakers10. Investors should keep an eye on employment, wage growth, and how it affects spending and corporate profits10.

“The challenge is to find the right balance between supporting workers’ incomes and controlling inflation. It’s a delicate tightrope that policymakers must walk carefully.”

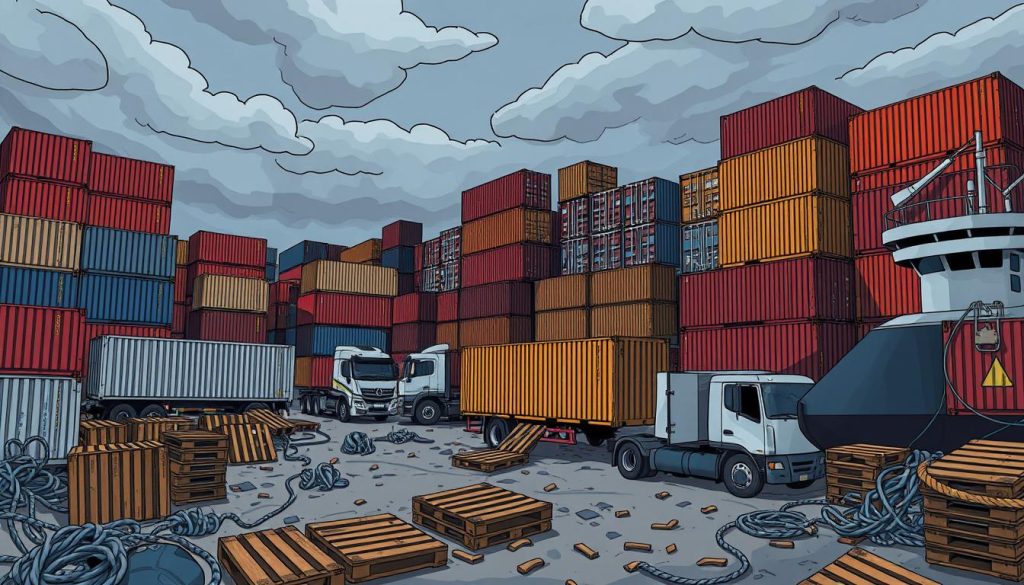

Supply Chain Disruptions and Inflation

The COVID-19 pandemic has caused ongoing supply chain disruptions, adding to the US inflation. Supply chain issues have led to shortages and logistical problems. These have made production costs higher for businesses, which then raises prices for consumers12.

How Supply Chain Issues Contribute to Rising Prices

The Global Supply Chain Pressure Index (GSCPI) rose sharply after the COVID-19 pandemic. This shows how severe the supply chain disruptions were. These issues have greatly increased inflation, adding about 60% to the inflation rate in 2021 and 202212. Fixing these supply chain problems is key to reducing inflation.

Supply chain disruptions have greatly affected inflation. A shock to the GSCPI can increase headline PCE inflation by about 0.5 percentage points at its peak. The effects of this usually fade away about a year later12. Also, a GSCPI shock can raise goods inflation by up to 1.5 percentage points, which is three times the effect on overall inflation12.

Investors need to keep an eye on global supply chains and their effects on their investments. GSCPI shocks were a big part of the inflation increase in 2021 and 2022. But, their impact has decreased from 2.5 to 1.4 since mid-202212.

“Resolving these supply chain issues will be crucial for easing inflationary pressures in the long run.”

Supply chain disruptions have had a big effect on inflation. A GSCPI shock can raise the unemployment rate by up to 0.7 percentage point. It can also increase the producer price index of crude materials by up to 10 percentage points12.

As the pandemic continues to affect the global economy, investors need to understand how supply chains are doing. This will help them see how inflation and economic growth are impacted.

Currency Devaluation and Inflation

Understanding how a country’s currency value affects inflation is key for investors. When a currency drops in value, it gets pricier to buy goods and services from other countries13. This can push up prices for people, making imports cost more. On the flip side, a strong currency can lower inflation by making imports cheaper13.

The value of the dollar has changed a lot over time. It went from 87.4 in 1980 to a peak of 143 in 198513. It then fell by about 35% since then13. These changes affect inflation, linking closely to the CPI and PPI13.

In the US, inflation rates from 2010 to 2020 ranged from 0.1% to 3.2%, averaging 1.2% in 202014. But by September 2022, it soared to 8.2%, mainly due to global and US factors, including the pandemic14. High inflation often leads to currency devaluation, as seen in the UK in 2008 when Sterling fell 25% and inflation went up15.

Investors should keep an eye on currency rates and their impact on investments, especially in international markets. Knowing how currency devaluation and inflation are linked can guide better investment choices and safeguard your money during economic ups and downs1314.

Conclusion

Understanding the factors behind rising prices is key in today’s inflationary times. Keeping an eye on the16 Consumer Price Index (CPI)17 is important. It hit about 8 percent in 2022, the highest in 40 years. Knowing what the Federal Reserve does to fight inflation helps you make smart choices for your investments.

Spreading out your investments and using things like Treasury Inflation-Protected Securities (TIPS) can help. Also, watch how supply chain issues affect18 prices. As wages and inflation change, paying attention to these trends is vital for investors wanting to protect their money.

Being able to handle the17 inflation and make smart investment moves is crucial. It helps keep your buying power and reach your financial goals. By staying updated and taking action, you can get through these economic challenges and come out stronger.

FAQ

What is the Consumer Price Index (CPI) and how does it measure inflation?

The Consumer Price Index (CPI) tracks changes in the prices of goods and services. It shows if living costs are going up. This means your money buys less over time.

How does high inflation impact your cost of living and household budget?

High inflation means your money doesn’t stretch as far. Things like food and gas cost more, taking a bigger chunk of your budget. This leaves less for fun and saving.

What is the role of the Federal Reserve in managing inflation?

The Federal Reserve helps control inflation by making policy decisions. It changes interest rates to affect spending. This helps keep inflation in check.

What strategies can investors use to protect their portfolios during periods of high inflation?

To protect your investments in high inflation, focus on asset allocation and diversification. Real estate, commodities, and TIPS often do well when prices rise. They keep their value or grow.

What are Treasury Inflation-Protected Securities (TIPS) and how can they help hedge against inflation?

TIPS are government bonds that adjust their value with the CPI. When prices go up, TIPS increase in value. This helps protect your money’s buying power.

How can high inflation impact the broader economy and overall economic growth?

High inflation can slow down the economy and even lead to recession. The Federal Reserve raises rates to fight inflation. This might cause a period of stagflation, with high prices and weak growth.

What is the relationship between wage increases and inflation?

Wage increases and inflation are linked in a complex way. Workers ask for higher pay to keep up with prices. But fast wage hikes can lead to more inflation, as companies raise prices to cover costs.

How have supply chain disruptions contributed to the current inflationary environment?

Supply chain issues during the COVID-19 pandemic have boosted inflation. Shortages and logistical problems have raised production costs. These costs get passed on to consumers in higher prices.

How can currency devaluation impact inflation?

A falling currency makes imports cost more, pushing up prices. A strong currency can lower inflation by making imports cheaper.