In the world of finance, knowing about volatility skew is key. It shows how different strike prices affect market expectations. This knowledge helps investors make better choices1.

Volatility skew looks at the gap in expected price changes for different options. It tells us what fund managers prefer, like writing call options or not1.

To figure out volatility skew, we compare the expected price changes of in-the-money, at-the-money, and out-of-the-money options1. This info helps traders understand market feelings and what options are in demand1. Implied volatility, or IV, is a big part of this. It shows how much price changes are expected by investors1.

Key Takeaways

- Volatility skew is a key tool for understanding market sentiment and options demand.

- Implied volatility measures the expected price volatility of a security.

- Forward skew and reverse skew are two types of volatility skew seen in different markets.

- Volatility skew hints at the expected risk direction in a security.

- Studying volatility skew patterns helps traders make better options trading decisions.

- https://criminalinjurylaw.com/settlement-scam-stories-how-lawyers-keep-your-payouts-for-themselves-10/

What is Volatility Skew?

Definition and Overview

Volatility skew is a key feature of options contracts. It shows that even with the same strike price and maturity date, options can have different implied volatilities2. This difference in implied volatility is between out-of-the-money, at-the-money, and in-the-money options2. It’s a graph that shows how market expectations vary3.

Importance in Financial Markets

For investors, volatility skew is a crucial tool. It tells them about market feelings and what fund managers think2. The skew’s shape hints at market expectations and future price moves2. A big change in the skew can signal unusual market activity, like during earnings reports or financial crises2. Watching the skew over time helps investors understand where the market is headed3.

| Characteristic | Description |

|---|---|

| Volatility Smile | The convex volatility “smile” shows greater demand for options when they are in-the-money or out-of-the-money versus at-the-money for certain underlying assets2. |

| Volatility Smirk | The volatility smirk indicates expectations of significant downward price movements, especially with a steep smirk2. |

| Factors Influencing Option Pricing | Five factors influencing option pricing are underlying stock price, strike price, time to expiry, interest rate, and implied volatility3. |

Understanding the volatility skew is key to analyzing the market fully2. Options trading can be profitable but is risky and not for beginners3.

“The shape of the volatility skew can provide insights into market expectations and potential future price movements.”

Learning about volatility skew helps you understand financial markets better. It can guide your investment choices423.

Understanding Implied Volatility

Implied volatility (IV) is key in options trading. It shows what the market thinks a security’s price will do over the option’s life5. IV changes affect option prices, going up when expectations or demand rise and down when they fall5. Options with shorter times to expiration are less affected by IV changes than those with longer times5. Options closer to the current market price are more affected by IV changes than those far from it5.

Relationship with Volatility Skew

Implied volatility and volatility skew are connected. Changes in the skew can help traders make moves5. Vega shows how much an option’s price changes with IV changes5. High IV means options cost more, and low IV means they cost less5. The VIX uses IV from near-dated, near-the-money S&P 500 index options5.

IV goes up and down in cycles, moving between high and low levels5. Forecasting IV helps traders make better trading choices5. High IV often comes before big news, making options prices jump. Low IV can mean good times to buy options5. Traders adjust their strategies based on IV, selling in high IV and buying in low IV5. Knowing about IV helps pick the right options strategies and strike prices5.

| Implied Volatility Characteristics | Impact on Options Pricing |

|---|---|

| Measures market’s forecast of likely price movement | Higher IV results in higher option premiums, lower IV leads to cheaper options |

| Tends to increase in bearish markets, decrease in bullish markets | IV is a key input in options pricing models like Black-Scholes |

| Not directly observable, must be calculated using pricing models | IV affects pricing of non-option instruments like interest rate caps |

| Sensitive to changes in supply, demand, and time value of options | Standard deviation used with IV to quantify expected price move range |

Implied volatility is a key tool for traders, showing market feelings and uncertainty6. Understanding IV and its link to volatility skew helps traders make better strategies and use market chances5.

“Implied Volatility (IV) is expressed as a percentage, computed using options-pricing models and reflects market expectations for future volatility of the underlying stock.”7

IV often moves back to its average, showing a mean-reverting pattern7. Comparing IV with historical volatility (HV) helps understand option pricing and stock volatility7. Knowing when IV is extreme can help predict stock price moves7.

Traders use IV levels for strategies, selling in high IV and buying in low IV7. The market stayed stable after NVDA earnings, heading towards highs7. Trading 0 (Zero) DTE Long Options is a popular strategy7.

How Volatility Skew Works

In the world of options pricing, it’s thought that two options with the same asset and expiration date should have the same implied volatility8. But, traders see things differently. They notice that when an option’s strike price is low, investors pay more for it. They see the downside as more valuable than the upside8. This difference leads to a volatility skew, as traders prefer writing call options over put options.

Assumptions in Options Pricing Models

Models like the Black-Scholes assume the underlying asset and market participants behave in certain ways9. They assume implied volatility is the same for all strike prices at a given date9. But, this isn’t always true in real life. The market sees risk differently based on the option’s strike price.

Investor Preferences and Strike Prices

Investors often want to protect against losses more than they want to gain8. This shows in the options market through a volatility skew. Out-of-the-money options with strike prices below the asset’s price have higher implied volatility8. After the 1987 stock market crash, OTM put options became more popular, changing the market pattern to a skew8.

As an option gets closer to expiring, more volatility is needed to hit OTM strike prices8. Implied volatility also goes up when markets fall and down when they rise8.

Knowing about volatility skew is key for traders and investors. It affects how they price and manage risks. By understanding what drives the skew, they can make better decisions and find opportunities in the options market.

Types of Volatility Skew

In the world of options trading, understanding volatility skew is key. There are two main types: reverse skew and forward skew. These patterns affect how options are priced and managed.

Reverse Skew

A reverse volatility skew means lower options have higher implied volatility. This is often seen in long-term or index options2. It happens when investors buy put options to hedge against market risks2. This pattern shows the market expects big price drops, making out-of-the-money put options more valuable.

Forward Skew

Forward skew is the opposite, where higher options have more implied volatility. It’s common in commodities markets, where supply and demand can push up prices2. This skew shows the market thinks prices might go up, making out-of-the-money call options more valuable.

Knowing about reverse and forward volatility skews helps traders and investors in the options market10. It lets them understand risks and opportunities better, helping them make smarter choices3.

“The volatility skew reflects market expectations of future price movements. A steep volatility smirk implies that the market anticipates a significant downward price movement.”10

student loans

Student loans are a big part of getting an education in the U.S. for many people. You might look into federal aid, check out private lenders, or think about consolidating your debt. It’s important to know about the different ways you can pay back your loans11.

Interest rates on student loans are something to think about. Federal loans usually have lower rates than private ones, which is why many students choose them11. Income-based repayment plans can also help by making your payments fit your budget12.

There are programs like Public Service Loan Forgiveness (PSLF) that can wipe out your student debt if you qualify. If money is tight, you might look into deferment or forbearance11.

Consolidating your loans could make paying back easier and might even lower your interest rate. But, make sure it fits with your financial plans11.

If you’re in school or paying off loans, it’s good to keep up with changes in student loans. This way, you can make smart choices and handle your money better12.

“Navigating the student loan maze can be daunting, but with the right information and strategies, you can take control of your financial future.”

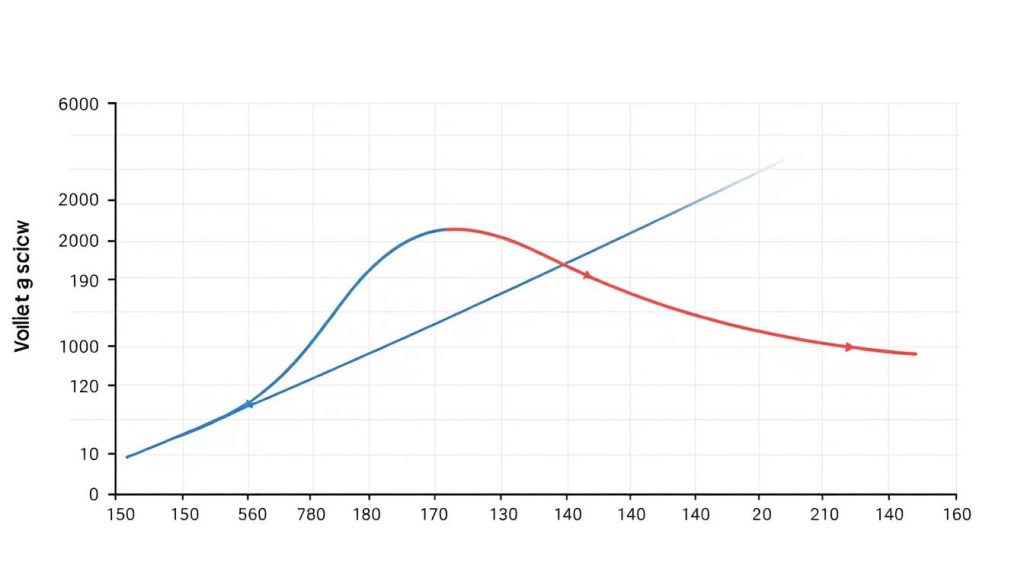

Graphical Representation of Volatility Skew

The graphical representation of a volatility skew is a key tool that shows how the market sees risk and what investors prefer. It shows the expected volatility of an option among others. If the graph is even, it’s called a volatility smile. If it leans to one side, it’s a volatility smirk13.

Volatility smiles are often seen in short-term options for stocks and currencies13. Options that are in or out of the money have the highest expected volatility13. Short-term stock and currency options usually follow a volatility smile. Index and long-term stock options tend to follow a volatility skew13.

After the 1987 stock market crash, the volatility smile became a key concept13. It shows a shift in how the market works and the awareness of big market moves13. Options with strike prices near the current market price usually have the lowest expected volatility13. Traders use the volatility smile to understand expected volatility at different strike prices for better trading13.

But, the volatility smile model isn’t always right because it can be affected by market factors like supply and demand13. The first volatility smile was seen after the 1987 stock market crash14. It’s a U-shaped pattern made by the expected volatility of different options with the same end date14.

When options that are out of or in the money have higher expected volatility than those at the money, it’s called a smile14. The expected volatility for puts and calls goes up as the strike prices move away from the market price14. The Black-Scholes model predicts a flat volatility curve, but extreme events can cause volatility smiles14.

Volatility smiles aren’t always the standard and don’t always match the real expected volatility of options14. Forex and short-term stock options usually follow volatility smiles, while long-term stock and index options might follow a skew14. A volatility smile might not always be perfectly U-shaped because of market imbalances like demand and supply14. Investors need to look at more than just the volatility smile when making trading choices14.

Strategies for Trading Volatility Skew

Volatility skew is a key tool for traders looking to make the most of market risk perception. By studying the patterns and shifts in volatility skew, traders can learn about fund managers’ preferences and the market’s bias15. For instance, a skew where put volatility is higher than call volatility suggests a bias towards hedging long stock positions16. This knowledge helps traders create strategies to protect their investments or earn income.

Analyzing Volatility Skew Patterns

Watching and understanding skew patterns is crucial for trading15. Implied volatility is more important for pricing options because it looks ahead, unlike historical volatility15. A spike in implied volatility raises option prices, while a drop lowers them15. Vega shows how an option’s price changes with volatility shifts15. Relative volatility compares the stock’s current implied volatility to its past levels15.

The Cboe Volatility Index (VIX) measures market volatility, especially for the S&P 500, known as the “fear gauge.”15 Traders often sell options when volatility is high and buy when it’s low15. Buying puts benefits from a bearish market when volatility is high15. Writing calls is about selling calls when volatility is expected to drop15. Short straddles or strangles aim to profit from lower volatility before options expire15. Ratio writing strategies involve selling more options than buying, hoping for a big drop in volatility15.

Understanding volatility skew patterns helps traders develop strong strategies for the markets16. Using this knowledge can help manage risks, seize market chances, and possibly boost investment returns16.

Conclusion

Volatility skew is a key tool for financial experts and options traders. It helps them understand market sentiment and investor choices. By looking at implied volatility across different strike prices, you can make better trading plans.

Whether it’s a reverse or forward skew, this graph shows how the market sees risk. Analyzing these patterns helps spot investment chances. Volatility skew is key for market analysis. Knowing it well can really help financial experts and traders.

Keep learning about volatility skew to improve your trading skills. Always be ready to adapt to new market changes. Use what you’ve learned from this article to make smart, strategic choices. Understanding and using volatility skew can greatly improve your financial success and market position.

FAQ

What is volatility skew?

Volatility skew is a tool that shows if fund managers prefer writing call options or not. It’s found by looking at the difference in implied volatilities of in-the-money, at-the-money, and out-of-the-money options.

Why is volatility skew important in financial markets?

It’s key for investors because it tells them about market feelings and fund manager preferences. Options traders use it to make money by understanding the market’s risk view.

What is the relationship between volatility skew and implied volatility?

Volatility skew and implied volatility are linked. Changes in skew can guide options traders in their strategies.

How do options pricing models handle volatility skew?

Most models assume all options with the same asset and expiration date have the same volatility. But, traders found that undervalued options were still overpaid for by investors.

What are the two main types of volatility skew?

There are two main types: reverse skew and forward skew. Reverse skew means lower strike options have higher volatility. Forward skew means higher strike options have higher volatility.

What are the key considerations for managing student loans?

Managing student loans involves looking at federal aid, interest rates, and repayment plans. Options like deferment and forbearance can help during tough times.

How is volatility skew graphically represented?

Volatility skew is shown graphically through the implied volatility of options. A balanced curve is called a volatility smile, and an uneven curve is a volatility smirk.

How can volatility skew be used as a trading strategy?

Traders use skew to understand fund manager preferences and market bias. This helps in making trading decisions, like selling calls or buying puts, to protect or profit from their investments.