Understanding coupon rates is key for a strong investment plan. The coupon rate is the yearly income from a bond1. It’s the payment made by the issuer based on the bond’s face value2. Bonds are important for a varied investment portfolio, offering steady income and stability against stock market ups and downs.

Learning about bond mechanics, what affects interest rates, and how interest rate changes impact bond prices helps you make smart investment choices. This knowledge is crucial for reaching your financial goals.

Key Takeaways

- Coupon rate is the nominal yield paid by a fixed-income security, such as a bond.

- Bonds with higher coupon rates provide a margin of safety against rising market interest rates.

- Current yield of a bond is the annual coupon payment divided by the current price of the bond.

- Market interest rates can affect the value of bonds, with higher coupon rate bonds being advantageous when rates are lower.

- Yield to maturity (YTM) of a bond can differ from its coupon rate, depending on the price paid.

Understanding Coupon Rates

The coupon rate is key in your investment strategy for fixed-income securities. It’s the interest rate the bond issuer pays to the bond holder3. This rate is a percentage of the bond’s par value and stays the same until the bond matures3. For example, a $1,000 bond with a 6% coupon rate pays $60 a year. A $2,000 bond with the same rate pays $120 a year3.

What Is a Coupon Rate?

The coupon rate is how much interest the bond issuer pays to bond holders4. It’s usually a fixed rate, but some bonds have variable rates or none at all4. To find the coupon rate, use this formula: Bond coupon rate = Total annual coupon payment / Face or par value of the bond x 1004. So, a $1,000 bond with a 4% coupon rate pays $40 a year4.

Coupon Rate vs. Yield

The coupon rate doesn’t change, but the bond’s yield can, based on market conditions3. The current yield compares the coupon rate to the bond’s market price3. If a $1,000 bond with a 6% coupon rate costs $1,000, its yield is also 6%3. But if it costs $800, the yield jumps to 7.5%3. The yield to maturity also considers the purchase price’s effect on returns3.

Knowing about coupon rates and yields is key to understanding bond investments3. Bonds with higher coupon rates than yields are bought at a premium because their fixed rates beat current rates3. Bonds with lower rates are bought at a discount5.

| Characteristic | Coupon Rate | Yield |

|---|---|---|

| Definition | The annual interest rate paid by the bond issuer to the bondholder | The total return an investor realizes on a bond, calculated by dividing the annual interest payment by the bond’s market price |

| Calculation | Total annual coupon payment / Face or par value of the bond x 100 | Annual interest payment / Current market price of the bond |

| Changes | Remains fixed throughout the bond’s maturity | Fluctuates based on market conditions and the bond’s purchase price |

| Relationship | Determines the periodic interest payments received by the bondholder | Reflects the total return the investor will receive on the bond investment |

In summary, the coupon rate is the fixed rate paid by the issuer. The yield shows the total return an investor gets based on the bond’s price4. Understanding these concepts helps you make smart choices in the bond market5.

“The coupon rate is the interest rate paid on a bond by its issuer for the term of the security. It is fixed when the bond is issued and is calculated by dividing the sum of the annual coupon payments by the par value.”

Coupon Rate: Its Significance in Bond Investing

The coupon rate is key in bond investing. It sets the yearly interest payments bondholders get6. Bonds with higher rates are more appealing because they offer more income6. The rate also changes how bonds are valued, making higher-rate bonds more valuable than lower-rate ones6. Knowing about the coupon rate helps in building a strong fixed-income portfolio and boosting investment returns.

In 2020 and 2021, many bonds had coupons under 3%, sometimes below 2%7. With rising interest rates, bonds with 4%, 5%, and 6% coupons have appeared from these issuers7. Investors see that lower coupon bonds offer yields similar to higher ones, despite giving less cash flow early on7.

The coupon rate is the yearly interest rate on a bond, setting the income for investors8. It means the interest an investor gets is the bond’s coupon rate as a percentage of its face value8. Bonds pay interest regularly, based on the coupon rate, until they mature8. For example, a $1,000 bond with a 5% coupon rate pays $50 a year8.

The coupon rate affects if a bond is priced high or low compared to market rates8. Bonds with a fixed coupon rate pay the same interest, while floating rate bonds change, and zero-coupon bonds are sold at a discount8. Market rates, the issuer’s credit, and economic conditions all play a part in setting coupon rates8.

Bonds with longer maturities often have higher coupon rates to make up for the longer wait8. The issuer’s credit rating also impacts the coupon rate, with lower ratings leading to higher rates due to the added risk8. These facts show how crucial coupon rates are in bond investing. They affect income, pricing, and how investments respond to market conditions.

How Coupon Rates are Affected by Market Interest Rates

Coupon rates on bonds change with the market interest rates when they are issued9. To find the coupon rate, you divide the yearly coupon payment by the bond’s face value, then multiply by 100 for a percentage9. When interest rates go up, bond prices drop9.

The Role of Central Banks

Central banks, like the Federal Reserve in the US, set short-term interest rates with tools like open market operations10. They raised the interest rate to 5.00%-5.25%, the highest in 15 years10. Changes in central bank policies affect market interest rates, which then change the coupon rates on new bonds.

Determining Long-Term Interest Rates

Long-term interest rates are set by market forces, like supply and demand for debt, inflation, and growth forecasts10. The interest paid on bonds is set at the time of issuance and stays the same10. When interest rates go up, bond prices fall, and vice versa11.

Research shows that11 70% of investors look at coupon rate when making investment choices11. Also, government bond coupon rates usually move with market interest rates11.

| Metric | Value |

|---|---|

| Average Coupon Rate on Corporate Bonds | 3.5%11 |

| Bond Value Decrease with 1% Rise in Interest Rates | 5%11 |

| Average Coupon Rate on High-Yield Bonds | 8%11 |

“When interest rates rise, prices of existing bonds tend to fall, leading to higher yields.”10

In low-interest-rate times, investors might choose bonds with lower coupon rates for steady income11. But, when interest rates change, these bonds’ values can drop a lot, and vice versa11.

Navigating Rising Interest Rates with Bond Strategies

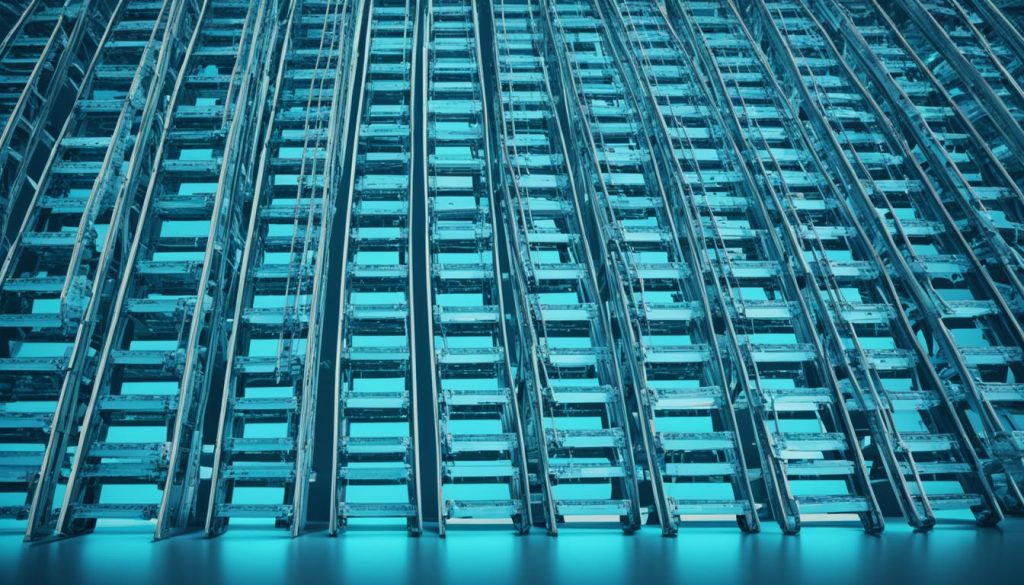

When interest rates go up, bond investors need to change their strategies. One good way is to spread out bond investments by maturity, known as bond laddering12. This means having bonds that mature at different times. This way, some investments will always be ready to be reinvested at the new, higher rates.

Investors might also look into shorter-term bonds that don’t change much with interest rates12. These bonds can help reduce the risk of losing money as rates go up. Also, looking into other types of bonds like floating-rate bonds or bank loans can help. These bonds have rates that change with the market, offering some protection against rising rates.

To make their bond investments more varied, investors could put some money into bond funds or ETFs focused on managing interest rate risk12. Funds like the ProShares Investment Grade—Interest Rate Hedged ETF (IGHG) and the ProShares High Yield—Interest Rate Hedged ETF (HYHG) aim to keep their duration at zero. This means they don’t have interest rate risk.

Using a mix of strategies for managing bonds can help investors deal with the ups and downs of rising interest rates13. By keeping an eye on the market, reinvesting at better rates, and spreading out their investments, investors can stay ahead. They can take advantage of new chances that come up.

| Bond Strategy | Description | Key Benefits |

|---|---|---|

| Bond Laddering | Building a portfolio of bonds with staggered maturity dates | Consistent reinvestment at higher prevailing rates, reduced interest rate risk |

| Shorter-Duration Bonds | Investing in bonds with lower sensitivity to interest rate changes | Minimized potential for capital losses as rates rise |

| Alternative Fixed-Income Investments | Exploring instruments like floating-rate bonds or bank loans | Ability to adjust to changing market conditions, variable coupon payments |

| Interest Rate Hedged Funds | Investing in bond funds or ETFs designed to maintain a duration of zero | Elimination of interest rate risk, potential for stable returns |

By using these bond strategies, investors can handle the challenges of rising interest rates. They can make their bond portfolio management work better. This keeps their investments diverse and reduces the effect of bond laddering on their returns.

“Navigating the bond market during periods of rising interest rates requires a thoughtful and proactive approach to portfolio management. By diversifying bond holdings, adjusting duration, and exploring alternative fixed-income options, investors can weather the storm and potentially capitalize on new opportunities.”

Impact of Interest Rates on Stocks and Bonds

The link between interest rates, stock prices, and bond prices is complex and ever-changing. When interest rates change, they affect both the stock and bond markets. This has big effects on financial markets and economic growth.

When interest rates go up, companies might see less profit. This happens because borrowing gets more expensive. This can make stock prices drop14. On the other hand, bond prices and interest rates move in opposite ways. So, when rates go up, bond prices go down, and vice versa14.

The effects of interest rate changes happen fast in the stock market15. But, the whole economy might take a year to really feel these changes15.

This shows why it’s key to understand how interest rates, stocks, and bonds work together. Knowing this helps with making smart investment choices across different types of assets.

| Impact of Interest Rates on Stocks and Bonds |

|---|

|

“The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap). The intelligent investor is a realist who sells to optimists and buys from pessimists.” – Benjamin Graham

Introducing Bond Funds: Diversifying Your Fixed-Income Exposure

Investing in individual bonds isn’t the only way to add fixed-income to your portfolio. Bond funds pool money from investors to buy a mix of bonds and other assets. This makes it easy to diversify your fixed-income investments16. Bond funds give you access to more issuers, maturities, and credit qualities. They offer professional management and can lead to better risk-adjusted returns16.

Income funds hold a mix of government, corporate, international bonds, and money market instruments16. Money market mutual funds focus on short-term, high-quality debt and cash, keeping their net asset values (NAV) close to $1 per share16. Corporate bond funds offer higher returns but come with risks based on the company’s creditworthiness16. For international exposure, look at international fixed-income funds, but be aware of currency exchange risks16.

Dividend-focused mutual funds also offer income, with dividends taxed as ordinary income or capital gains16. The U.S. Securities and Exchange Commission has updated rules to ensure funds match their names, offering investors more transparency16.

Mutual funds help spread risk across different assets in one investment16. By choosing bond funds, you can tap into a wider range of fixed-income opportunities. This can improve the risk-return mix of your portfolio.

| Mutual Fund Type | Investment Focus | Key Characteristics |

|---|---|---|

| Fixed Income Mutual Funds | Government bonds, corporate bonds, international bonds, money market instruments | Offer diversification, professional investment management, and potential for improved risk-adjusted returns |

| Money Market Mutual Funds | Short-term, high-quality debt and cash equivalents | Maintain stable net asset values (NAV) around $1 per share |

| Corporate Bond Income Funds | Corporate bonds | Offer higher yields, but with varying levels of risk linked to issuer creditworthiness |

| International Fixed Income Funds | Foreign government and corporate bonds | Provide international diversification, but with currency exchange rate risks |

| Dividend-Focused Mutual Funds | Dividend-paying stocks | Provide income, with dividends potentially taxed as ordinary income or capital gains |

Exploring bond funds can help diversify your fixed-income investments and improve your portfolio’s risk-return balance16. Whether you want government, corporate, or international bonds, bond funds are a convenient, professionally managed option for your investment goals.

Coupon Rate and Bond Volatility

The coupon rate is key in understanding bond volatility. Bonds with lower coupon rates tend to be more affected by interest rate changes17. This is because they have a longer duration, meaning they take longer to mature and their cash flows are valued more in the present. So, their prices change more with interest rate changes.

Duration: Measuring Bond Price Sensitivity

Duration is a key metric for understanding how a bond’s price changes with interest rates17. Longer-duration bonds are more volatile, meaning their prices change more with interest rates. Shorter-duration bonds change less with interest rates, making them less volatile.

Factors Influencing Bond Volatility

Many factors affect a bond’s volatility17. Call provisions, which let issuers redeem bonds early, make bonds more volatile. Bonds with call features can have early redemption, adding uncertainty. Credit risk also plays a part, as bonds with lower ratings are more volatile due to higher default risk.

To manage bond volatility and increase returns, investors should think about the coupon rate, duration, and other factors when building their portfolios. Understanding what makes bonds volatile helps investors make better choices and improve their investment plans.

| Maturity | Coupon Rate | Price Change |

|---|---|---|

| 5 years | 3% | -3.75% |

| 10 years | 5% | -6.25% |

| 20 years | 6% | -12.5% |

“Understanding bond volatility is crucial for investors seeking to optimize their fixed-income portfolios and navigate the complexities of the bond market.”

By looking at factors like coupon rate, duration, and credit risk, investors can make better decisions and handle bond price changes17. This knowledge helps them deal with interest rate changes and increase their returns over time17.

Conclusion

When you look into the bond market and fixed-income securities, knowing about coupon rates is key. They affect your investment strategy and portfolio management. The coupon rate sets the yearly interest you get from a bond18. It also changes the bond’s yield and price19.

Understanding how coupon rates work with market interest rates and bond risks helps you make better choices. You can pick shorter bonds, bond funds, and manage your bonds to get the best returns. This way, you can handle changes in interest rates and make your financial planning work for you.

The coupon rate is a big part of bond investing. Knowing about it lets you make smarter choices that fit your financial goals. Use what you’ve learned and keep exploring the bond market to improve your investment strategy.

FAQ

What is a coupon rate?

A coupon rate is the interest rate on a bond. It’s the yearly payments the issuer makes. These payments are based on the bond’s face or par value.

How does the coupon rate differ from the yield to maturity (YTM)?

The coupon rate is the interest rate paid by a bond issuer over its term. The yield to maturity (YTM) is the total return an investor gets from a bond. YTM can be higher or lower than the coupon rate, based on the bond’s market price.

Why is the coupon rate important for bond investing?

The coupon rate is key for bond investing because it sets the annual interest payments. Higher coupon rates mean more income for investors. This rate also affects the bond’s value, making higher-coupon bonds more desirable.

What factors influence the coupon rate?

Coupon rates are mainly affected by market interest rates at bond issuance. The Federal Reserve sets short-term rates. Long-term rates are shaped by market forces, like supply and demand, inflation expectations, and growth forecasts.

How can investors manage the impact of rising interest rates on their bond portfolios?

To handle rising interest rates, investors can diversify their bonds by maturity. They can look into shorter-duration bonds, explore other fixed-income options, and use a bond ladder approach.

How do interest rate changes affect the stock and bond markets?

Higher interest rates can greatly affect the stock and bond markets. Companies face higher borrowing costs, which can lower their profits and stock prices. Bond prices also fall when rates go up, and vice versa.

How can bond funds help diversify fixed-income exposure?

Bond funds pool money to buy bonds and other assets. They offer a way to diversify your fixed-income investments. With bond funds, investors can tap into a variety of issuers, maturities, and credit qualities. This can lead to better risk-adjusted returns with professional management.

How does the coupon rate affect bond volatility?

Bond volatility is mainly due to interest rate changes. Longer bonds and those with lower coupon rates are more sensitive to price changes. Duration measures how much a bond’s price will change with interest rate changes.

Source Links

- What Is the Coupon Rate on a Bond and How Do You Calculate It?

- Bond Coupon Interest Rate: How It Affects Price

- Bond Yield Rate vs. Coupon Rate: What’s the Difference?

- What Is the Coupon Rate of a Bond? | SoFi

- What Is a Coupon Rate? | The Motley Fool

- What Is a Bond Coupon, and How Is It Calculated?

- What’s in a Coupon?

- Coupon Rate | Definition, How It Works, Significance, and Types

- Coupon Rate – Learn How Coupon Rate Affects Bond Pricing

- Bond Basics: How interest rates affect bond yields | Natixis Investment Managers

- Bond Prices, Rates, and Yields – Fidelity

- Bond Strategies for Rising Rates—Shorten, Float or Hedge?

- What are bond yields? How do rising yields affect investors?

- Inverse Relation Between Interest Rates and Bond Prices

- How Do Interest Rates Affect the Stock Market?

- Fixed Income Funds: Income and Diversification

- What Is Coupon Rate and How Do You Calculate It? Formula and Example

- Bond Yield: Understanding the Relationship between Bond Price and Coupon Rate – FasterCapital