If you’re into investing, you’re always searching for ways to make smart moves in the market. Mean reversion is a strategy that’s caught a lot of attention lately. It suggests that asset prices and returns will swing back to their average over time1.

Using mean reversion can lead to big wins, but it’s not without its risks. In this piece, we’ll get into the details of mean reversion. We’ll look at how it works, what affects it, and how to use it to your advantage while avoiding the downsides.

Key Takeaways

- Mean reversion is a strong tool for spotting and making the most of short-term market swings.

- To succeed with mean reversion, you need to understand things like volatility and how trends change.

- It’s key to use risk management tools like stop-loss orders and set profit targets when trading mean reversion.

- Combining mean reversion with momentum strategies can make your portfolio more varied and strong.

- Testing your strategies and keeping an eye on the market is vital for making sure they work well over time.

What is Mean Reversion?

Financial markets rely on the idea of mean reversion2. This means asset prices and earnings tend to go back to their average over time. After moving away from it, they return to their long-term average2. This pattern is seen in many market metrics, like volatility and earnings, and is key for analyzing technical indicators2.

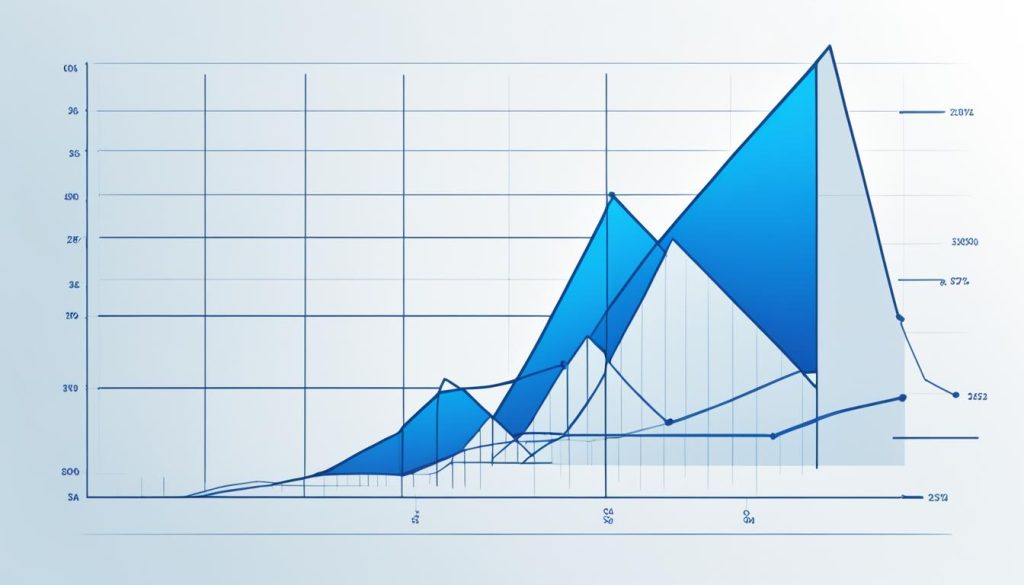

Investors use mean reversion to make money when prices move away from their average2. Tools like moving averages, RSI, Bollinger Bands, and stochastic oscillator help spot these opportunities2. Traders look at Z-scores to see how much an asset’s price is off from its mean. A score over 1.5 or under -1.5 might signal a good time to trade2.

Mean Reversion in Trading

Trading with mean reversion means prices usually come back to average levels3. Extreme price changes are hard to keep up for a long time3. In trading, the mean is often a simple moving average, which is the average price over a set period3. These strategies aim to make money as prices move back to normal3.

Pairs trading is about picking two related assets and trading them when their price ratio is off from the mean2. Algorithmic trading uses complex math to predict price changes based on mean reversion2.

Intraday traders look at short-term averages, RSI, and other tools to find overbought or oversold conditions for mean reversion2. Swing traders use longer averages and other indicators to spot reversals that could mean mean reversion2. Forex traders also use these tools to find mean reversion chances in currency pairs2.

“Mean reversion in trading postulates that prices tend to revert to average levels and extreme price moves are difficult to sustain for extended periods.”3

| Trading Strategy | Mean Reversion Tools |

|---|---|

| Intraday Trading | Short-term moving averages, RSI, stochastic oscillators, Bollinger Bands |

| Swing Trading | Longer-term moving averages, RSI, MACD, Fibonacci retracements, candlestick patterns |

| Forex Trading | Moving averages, RSI, stochastic oscillators, pivot points |

The Role of Mean Reversion in Financial Markets

Mean reversion is a key idea in financial markets. It says that asset prices will move back to their long-term average over time4. When prices are far from the average, they’re likely to come back closer soon4. Traders use this idea to make money by spotting price changes.

In the EUR/USD and commodity markets, mean reversion is popular. Traders use tools like moving averages and the Relative Strength Index (RSI) to find the best times to buy or sell4. They buy low and sell high, using the fact that prices tend to average out over time4.

But, mean reversion strategies have limits. In markets that keep moving in one direction, they might not work well4. Also, surprises in the market can make prices jump, affecting mean reversion and offering new chances for traders4.

Still, mean reversion is key in many trading plans in financial markets5. Studies show it’s real in stocks, commodities, bonds, and currency rates, which challenges the idea that markets are perfectly efficient5. For investors and traders, knowing about mean reversion is a big help.

In summary, mean reversion is important in financial markets. It helps traders and investors by showing how prices tend to return to their average. By using tools like technical analysis, they can make money from these trends6.

Factors Influencing mean reversion

Mean reversion is shaped by many market forces. Changes in market sentiment can cause big changes in stock prices. These changes usually go back to normal over time7. The mean-reverting nature of stock fundamentals shows that prices can swing a lot. This makes it key to have good risk management strategies7.

For traders looking for mean reversion, technical indicators like RSI and Bollinger Bands are very useful7. These tools help spot good trading chances based on this idea8. Tests like the Augmented Dickey-Fuller (ADF) test also check if a market tends to mean revert with numbers7.

Volatility itself often goes back to its normal state. This shows that the market likes to find balance7.

| Technical Indicator | Description |

|---|---|

| Moving Average (MA) | Tracks the average price of an asset over a specified time frame, identifying potential mean-reverting actions8. |

| Bollinger Bands | Uses standard deviation to create upper and lower bands around the moving average, showing where mean reversion might happen8. |

| Relative Strength Index (RSI) | Measures price speed and change, showing when assets are too high or too low, helping with mean reversion trades8. |

These technical indicators, along with knowing about market sentiment, stock fundamentals, and volatility patterns, are key for a good mean reversion trading plan7. Using this approach, traders can move through the financial markets with more accuracy and confidence.

Building a Successful Mean Reversion Trading Strategy

Creating a winning mean reversion trading strategy takes a detailed plan. Start by picking financial assets that match your goals and risk level. Stocks are great for this strategy because they often return to their average price over time9.

At the heart of your strategy is fundamental analysis. It helps you compare and evaluate assets. This method works well with pairs trading. Here, you use mean reversion tools to find the best times to buy and sell10.

- Use tools like Bollinger Bands, moving averages, and MACD indicators to spot assets that are far from their usual prices11.

- Keep an eye on stock fundamentals, volatility, and how mutual funds behave. These often bounce back to their normal levels11.

- Manage your risk by setting the right trade size. Avoid relying too much on stop-loss strategies, as they might not work well in mean-reverting markets10.

It’s important to keep improving your trading strategy as markets change quickly. By staying alert and flexible, you can increase your chances of doing well in this fast-paced trading world10.

| Metric | Value |

|---|---|

| Number of trades using the mean reversion trading strategy in the stock market | 389 |

| Winning rate of the mean reversion trading strategy in the stock market | 86.84%9 |

| Average profit percentage of trades utilizing the mean reversion trading strategy in the stock market | 1.39%9 |

| Number of trades using the mean reversion trading strategy in the Russell 1000 Universe when applied to individual stocks | 6,7119 |

| Winning rate of the mean reversion trading strategy in the Russell 1000 Universe when applied to individual stocks | 66.95%9 |

| Average profit per trade when applying the mean reversion trading strategy to the Russell 1000 Universe | $0.459 |

| Average annual return achieved by trading the Russell 1000 Universe using the mean reversion strategy | 12.29%9 |

By adding these key elements to your strategy, you can improve your chances of success in the markets. Always keep refining your approach to stay ahead in the ever-changing market10.

Identifying Mean Reversion Entry and Exit Points

At the core of mean reversion trading is finding the best times to buy and sell. By watching Bollinger Bands, Relative Strength Index (RSI), and other indicators, you spot assets that are far from their usual prices. This means they might soon return to normal12.

Bollinger Bands show changing levels of support and resistance. They suggest when to buy or sell if assets are too high or too low. The middle line of the Bollinger Bands tells you when it’s time to leave your trade12.

How often you trade depends on how long you plan to hold an investment. Day traders look for quick changes, while swing traders wait for bigger moves. They use tools like the Moving Average Convergence Divergence (MACD) for guidance12.

Using Bollinger Bands, RSI, and MACD together gives stronger signs of mean reversion than any one indicator alone. This mix helps you time your trades better12.

“The confluence of several technical indicators can solidify signals of mean reversion better than any single metric alone could do so—forming a harmonious ensemble that guides the rhythmical movement into and out of market positions.”

But, mean reversion strategies have their challenges. Volatility, trends, and costs can affect their success. It’s key to use strong risk management, like stop-loss and take-profit, to deal with market ups and downs1213.

By looking at Bollinger Bands, RSI, MACD, and other indicators, you can find the best times to enter and exit trades. This approach helps you follow the market’s patterns and could lead to profitable trades12.

Risk Management Techniques

Dealing with the ups and downs of financial markets needs a strong risk management plan. The mean reversion strategy uses key safeguards like stop-loss and take-profit levels. These measures help protect against market ups and downs and false signals of mean reversion14.

Spreading investments across different trades is key for mean reversion traders. It lowers the risk from one asset’s sudden change and protects against big losses in less liquid markets14. Keeping a good risk-to-reward ratio is also crucial. It means watching trade lengths and market exposure for a better long-term result14.

Optimizing Risk-Adjusted Returns

Success in mean reversion trading is about finding the right balance between returns and risk control. Focusing on risk management often leads to better results. Tools like Monte Carlo simulations and Value at Risk (VaR) help predict and measure risks14. Choosing less volatile assets and reducing their connection helps build a strong mean reversion strategy that can handle market ups and downs14.

| Risk Management Techniques | Description |

|---|---|

| Stop-Loss and Take-Profit Thresholds | Predefined levels to limit losses and lock in gains |

| Diversification | Spreading investments across multiple trades to reduce volatility |

| Correlation Management | Selecting assets with low or negative correlation, avoiding industry/geographic clustering |

| Risk-to-Reward Ratio Optimization | Maintaining a favorable balance between return potential and drawdown control |

| Statistical Modeling and Simulations | Employing techniques like Monte Carlo analysis and Value at Risk (VaR) to quantify risks |

A strong mean reversion trading strategy needs a full risk management plan. This plan protects against the risks of financial markets’ ups and downs. By using data and focusing on risk, traders can trade with confidence and aim for long-term success14.

Conclusion

Mean reversion is key in financial markets, guiding many trading strategies in stocks, forex, and commodities. It’s vital for investors and traders to grasp how mean reversion works, what affects it, and how to use it in trading. Choosing the right assets and using technical indicators for timing are important steps. Also, having strong risk management with stop-loss and take-profit rules is crucial15.

By mixing mean reversion with momentum strategies, traders can boost their success chances and reduce risks in the market15. Knowing about mean reversion helps investors make better, strategic choices. This leads to a more stable financial world16.

When exploring mean reversion, always keep an eye on diversification and market stability. This ensures your financial plans can handle market changes. Using the insights from this article, you can trade with more confidence and reach your investment goals16.

FAQ

What is mean reversion?

Mean reversion is a key idea in finance. It says that asset prices and earnings will return to their average over time. This happens after they move away from it. It shows a pattern where prices always move back to the mean in financial markets.

How does mean reversion play a role in financial markets?

Mean reversion is vital in financial markets. It guides trading strategies in stocks, forex, and commodities. When prices like EUR/USD go off average, traders use mean reversion. They use tools like moving averages or the RSI to find the best times to trade.

What factors influence mean reversion?

Many things make asset prices return to their average. These include changes in market feelings, the natural tendency of stock basics to balance out, and the return of volatility to its normal state.

How can you build a successful mean reversion trading strategy?

Creating a good mean reversion trading strategy takes a lot of work. You need to pick the right assets, find the best times to buy and sell, manage risks, and keep improving your strategy as the market changes.

How do you identify mean reversion entry and exit points?

Technical indicators like Bollinger Bands and RSI show when assets are too high or too low. This means they might soon return to average prices. Bollinger Bands give support and resistance levels for buying or selling. Their middle line shows when it’s time to exit.

What risk management techniques are important for mean reversion strategies?

Mean reversion strategies need a strong risk management plan. This plan helps traders deal with market ups and downs. It includes setting stop-loss and take-profit levels around the average price to protect investments.